Short-Termism

Its Causes, Effects and Possible Remedies

Andrew D. Hendry

Retired Vice Chairman, Chief Legal

Officer and Secretary

Colgate-Palmolive Company

Introduction

This paper will discuss short-termism and its causes, effects and

possible solutions.

By way of background, I have been practicing law for almost 45 years, about

35 as a lawyer/ businessman for public companies (including more than 25 years

as the chief legal officer of two global Fortune 200 companies). Through that

experience, I have witnessed first-hand how short-termism has changed corporate

America and continues to damage America business and our economy. This has been of great concern to me and so

for a number of years I have worked with The Conference Board and others developing

possible solutions.

What is Short-Termism?

Short-Termism requires that a public corporation deliver quarterly

results meeting Wall Street’s quarter-by-quarter expectations, even if so doing

damages its business health and the long-term best interests of the

corporation. It is a harmful practice which is stunting the growth of American

companies by:

·

Preventing investments needed for long-term

growth in order to protect quarterly earnings

·

Excessively using corporate funds for dividends

and stock buy-backs to prop up “TSR” (Total Shareholder Return or, in other

words, stock price appreciation and dividends) to meet Wall Street’s

quarter-by-quarter demands

·

Pursuing corporate transactions (like mergers,

acquisitions, spin-offs, divestitures, inversions, etc.) which may enhance

stock price or free up cash for distribution to shareholders, but compromise

the health/growth of the company’s business long-term

·

Excessive cost-cutting and restructuring, enhancing

earnings and freeing up assets to meet Wall Street’s short-term demands, but

mortgaging the company’s ability to build for the future

·

Distracting corporate management from long-term

growth, as they are preoccupied with meeting Wall Street’s short-term demands.

The result of this short-term Wall Street focus is to

hobble corporations by diverting assets that are better and rightfully directed

at supporting the corporation’s long-term growth, which will benefit customers,

employees and communities, as well as shareholders. Short-Termism is having disastrous effects

on the long-term health of American corporations and the American economy.

What Are the Causes of Short-Termism?

There are many factors that contribute to Short-Termism.

We read about these (executive compensation, high-speed trading, hedge funds

and others) in the media frequently. However, beneath it all, are two realities

of the current corporate environment which are the foundation upon which Short-Termism

is built:

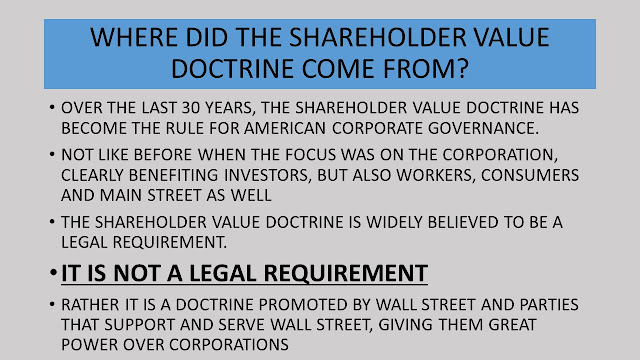

1. Shareholder Value Governance

Over the last 30 years, the Shareholder Value Doctrine

has become the model for American corporate governance. This doctrine (sometimes

called the “agency theory” reflecting its erroneous view that directors are

agents of the shareholders) provides that the Board of Directors and management

must govern the corporation with the objective of increasing shareholder value,

giving little or no regard to the interests of other stakeholders like consumers,

employees and communities. Like trickle

down economics, this theory is based on the belief that everyone will benefit

if shareholders do.

The Shareholder Value Doctrine, which Jack Welch is

reported to have once described as the stupidest idea ever, is widely believed

to be a legal requirement. As eloquently

explained by Professor Lynn Stout in her book, The Shareholder Value Myth,

it is not. Rather, this corporate governance theory has been promoted over time

by mis-guided academics, self-interested parties and others. Over time, a “shareholder value industry” comprised

of academics, activist shareholders, hedge funds, institutional investors, Wall

Street analysts, the financial media, executives, lawyers, accountants, proxy

advisers, compensation consultants and others has developed. This “industry” wields

great power over corporations and their Boards and managements and demands

unquestioned loyalty to the doctrine.

As a result, the Shareholder Value Doctrine has all but

totally replaced the previous stakeholder approach to corporate governance. That

earlier approach, which governed thinking for decades, recognized that the duty

of the Board and management of a corporation was to the corporation as a legal

person and its best interests. It recognized that the duty required providing a

fair return to shareholders and protecting their long-term interests, but also espoused

as consistent with that goal supporting the interests of employees, consumers,

communities and other non-shareholder stakeholders. According to this Stakeholder

Doctrine, Boards and managements of corporations should act to protect and

develop the corporation for the long-term and through that investors, as well

as employees, consumers and communities, would prosper.

Now, however, Shareholder Value thinking has become so

ingrained in corporate governance that boards and management are in many cases

not even aware that they have the freedom (perhaps even the duty) to take a

more balanced long-term approach, focusing on the long-term interests of the

corporation for the benefit of its shareholders and consistently the interests

of other stakeholders.

2. Wall Street -- for traders, not investors

At the same time that shareholder value became the almost

exclusive focus of corporations, Wall Street moved from an investment community

to a trading community. For example, in 1960 the average holding period for stock

exceeded nine years. By 2000, this was down to a little over a year and in 2010

it had decreased to six months. The stock market moved from a community composed

significantly of individual and small investors investing in companies for the

long-term to a market dominated by large institutions, the vast majority of

which are focused on making returns through short-term trading, not long-term

investment.

Consequently, since the Shareholder Value Doctrine

demands that corporations be run to increase the value to shareholders and the

shareholders want short term gains, Boards and managements are compelled to

govern the corporation to produce short term increases in shareholder value. And,

although they might not be willing to admit it, they are compelled to do this

even at the expense of the long term best interests of the organization and its

business, and regardless of the impact on long term investors, workers, customers

and communities.

What Are the Consequences of Short-Termism?

People talk about the dry recovery like it is the result

of some unknown virus which invaded America and which the CDC has been unable

to identify and stop. It is certainly not that and it is not at all mysterious.

Although Short-Termism may not be the only culprit, it is a major if not the

principal contributor to this most serious problem.

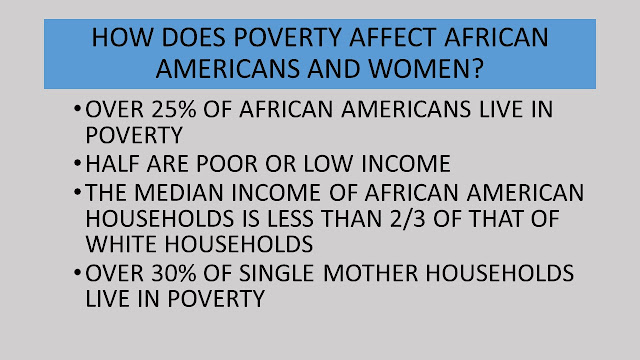

The statistics are staggering. US real household median income

dropped from 1999 to 2010. Between 2000

and 2010, those living in poverty in this country rose by a third to over 15%.

On the other hand, the Dow soared from around 7000 in 2009 to over 18,000 in

2015. Having once had a middle-class which was the envy of the world, America

now finds itself as the only place in the world expected to have a shrinking

middle class over the next decade.

This cannot continue. It is not possible to have a well-functioning

democracy where the fruits of its industrial strength are siphoned off for the

benefit of an elite group primarily in the financial sector, depriving

America's business organizations of the resources needed to grow and keep the

United States the economic leader it is. Non-financial business investment has

declined and as one report asked: " so what have companies been doing with

their cash?" The answer is simple: they have been using it to respond to

the demands of Short-Termism. It has been reported that from 2003 to 2012, 449

public companies in the S&P 500 used 54% of their profits for stock buy-backs

and 37% for dividends, leaving a paltry 9% for reinvestment in the business. A

little private study of some companies I know that I did at the end of the 3rd

quarter of 2015 showed that all 5 companies paid out more cash to stockholders

in dividends and buy-backs than they took in from operations, one by over

200%. Every American knows what happens

eventually if you keeping paying out more than you take in. Unless corporations begin again spending a

substantial portion of their earnings on investment for long-term growth, there

is no question that they will not be able to provide the product and other improvements

that American society deserves or the opportunities for its workers

(particularly the young) that this country has been so famous for and that

America's citizens are entitled to.

How Can This Be Fixed?

Unfortunately, there is no quick fix to Short-Termism.

Short-Termism took decades to develop and fixing it will involve a journey to

move the corporate community and Wall Street to a long-term growth focus. In an

ideal world, voluntary action by corporate boards and management and Wall

Street toward a long-term growth focus would go a long way to solving the

problem. However, Short-Termism and the Shareholder Value Industry are now so ingrained

in our business environment, it is unlikely that without some government

intervention things will change.

The Current Debate

A substantial debate about income inequality in America

is taking place.

Some suggestions of changing the capital gains tax to encourage

long-term investment and imposing a tax on short-term, high-volume trading. Of

course, the devil will be in the details but fundamentally both of these

proposals can help solve the problem.

There has been much talk about raising the minimum wage. Raising the minimum wage may be a needed

short-term fix given the appallingly low wage rates of many hard-working

Americans, but it is no long-term solution. Anyone who has taken a basic

economics course or worked in business knows that the reaction to that will be reduced

employment to control costs. And absent price controls, prices will eventually rise,

as increased costs and demand push corporate managers to raise prices,

eliminating any benefit of the higher wages over the long term.

Ideas to Explore

Below are some ideas which could be explored to help end Short-Termism

and bring back into balance short-term and long-term planning and the use of

America's corporate resources for investment in the future as opposed to

current returns to Wall Street traders:

·

The SEC Could Enhance Disclosure To Bring More

Focus On The Long Term: One possibility is to increase disclosure about the

long term. Currently, American public

corporations devote enormous effort focusing on short-term results. They report

quarterly and annual results and discuss them at length in their MD&As;

they discuss these results and forecasts in quarterly analyst calls and make

presentations about them at investment conferences. There is precious little or

no discussion about long-term strategy, forecasts or valuations, or other

long-term factors.

The SEC could substantially

increase disclosure requirements about the long-term. For example, ’34 Act

filings or proxy statements could contain a comprehensive report (including formal

projections) on the long-term strategies and prospects for the company, like the current CD&A does for executive

compensation. Of course, long-term projections are less certain and will of

necessity evolve over time. But creating transparency in this area would encourage

corporations and Wall Street to focus on the long-term as a key measure of

success and a key criteria for investment decisions.

·

Restrict Quarterly Forecasting: Another

proposal which has been made would prohibit public corporations from giving

quarterly earnings guidance. Proponents of this idea argue that it would free

up corporate managers to focus more on the long-term by making them feel less

responsible for meeting Wall Street's quarterly estimates and make them less

inclined to adjust expenses to meet quarterly forecasts. Although the proposal

has merit, it could make Wall Street's quarterly targets less reliable and

thereby increase volatility. Also

corporate managers will still feel driven to meet Wall Street's quarterly expectations

even if they had little to do with setting them.

·

Improve Corporate Governance: Corporate

governance is largely a matter of state law. However, particularly since

Sarbanes-Oxley and Dodd-Frank, there is much precedent for the Federal Government

involvement in public company governance. Here are some ideas of things that might be

done:

o Directors

of public companies could be licensed (as lawyers and accountants are) and/or

required to take director education courses, both designed to bring focus on their

duties as directors to promote the long-term health of the corporations

o Recognizing

that excessive stock buybacks are a form of gradual liquidation of the company

to the detriment of creditors and other stakeholders, the SEC could issue a

rule (like the NYSE 20% rule) requiring stockholder approval if buybacks exceed

a certain percentage

o The

German model of governance where representatives of other stakeholders in

addition to investors are represented on the Board could be considered. (See,

for example, how Lufthansa is governed)

·

Reign In Activist Investors: In principle,

there is nothing wrong with activist investing.

If a substantial investor finds that a company is being mismanaged, it

should have the ability to take action to correct the problem. However, that is

not what activist investing means today. Using the above principle as cover and

America's current cheap money as funding, many activist investors are invading

American companies for the purpose of generating short-term gains. For example,

in 2014 activists gained board seats at 107 companies. From late 2008 to

mid-2015, there were 220 public activist campaigns to increase payouts to

shareholders, largely through increased stock buybacks. A recent study estimated

that not more than 2% of activist campaigns are focused on improving long-term

performance. The consequences of these activist campaigns are dire, busting up

properly functioning companies with good futures, draining corporate resources

to improve TSR, firing employees unnecessarily, cutting R&D, all justified

by the current Short-Termism and Shareholder Value Governance Doctrines. More

than others, activist investors are the enforcers of short-termism.

Sadly, the activist plague has

been left unchecked. They are essentially unregulated by the SEC. Much could be done to impose appropriate

regulation on their activities. For example, the imposition of Regulation 13-D

disclosure requirements on activist investors would give companies fair warning

and an ability to prepare to deal with them. Instead, activist investors are

now allowed to act in unregulated "wolf packs" as opposed to

regulated Section 13-D groups. They are allowed to exercise their right of

“free speech” and put out highly inflammatory and questionable white papers

without any disclosure controls, all to put pressure on Boards and managements

to yield to their demands. Expanding merger preclearance requirements (H-S-R)

to include an evaluation of the impact of an activist transaction (such as the

current Dow-DuPont or Kraft-Heinz mergers) on consumers, workers and the public

would help prevent the negative impacts of these transactions. Basically, a set

of regulations that ensures that activist investors are not corporate raiders,

crippling and dismantling America’s industrial base, is needed.

·

Wall Street Needs To Be Made More Transparent:

It has always struck me as ironic that institutional investors have for decades

pushed to increase corporate transparency, while they themselves are among the

most opaque institutions. When I think

about Main Street’s relationship to Wall Street, I am reminded of the line from

Shakespeare's Julius Caesar "the fault, dear Brutus, is not in our stars,

but in ourselves..." In many cases,

it is the money of Main Street invested in Wall Street’s institutions which is

being used to promote the very Short-Termism harming Main Street. Needless to

say, it would be a complicated process to develop a system of transparency for

Wall Street giving Main Street investors more control over how their money is

being used, but one has to wonder why that wasn’t done a long time ago.

·

Improve Wall Street’s Governance Of Its Investments: The lack of Wall Street transparency is

compounded by the way many institutional firms vote the shares of public

corporations they hold. For example, many firms effectively delegate the

decision as to how to vote on executive compensation (“Say on Pay”) and other

matters to Institutional Shareholder Services (“ISS”). ISS is an unregulated,

for-profit corporation which can through its recommendations effectively control

as much as around one-third of a corporation’s shareholder vote on any matter.

Therefore, ISS’s views heavily influence executive pay and other corporate governance

proxy proposals. The question becomes whether a for-profit, unregulated

organization accountable to no one should have this much influence on executive

compensation (see discussion below) and other corporate governance matters.

·

Executive Compensation Should Be Made More

Long Term: The strong tie between short-term stock performance and

executive compensation was developed in an effort to create a "pay for

performance" environment, aligning the interests of management with those

of the stockholders. Unfortunately, the pendulum has probably swung too far.

With Wall Street focused on short-term results, many of the aligned

compensation systems (such as options, restricted stock programs and 3-year

“long term” bonus programs) also focus on short-term results, many tied to Wall

Street by being tied to earnings per share or stock price performance. Much of

the design work of executive compensation programs is done by a small handful

of compensation consultants. They are heavily influenced by the practices of

peer companies and by the guidelines of ISS (described above). The result is

very much a follow-the-leader approach resistant to change. Using the tax laws,

the Federal government does have the power to influence the short-term nature

of executive compensation, such as was done by Section 162 (m) to address

non-performance based compensation or Section 280G for golden parachutes.

·

Tax Policy Can Be Used To Encourage Long-Term

Planning: Tax policy (as opposed to direct regulation) can be used as a

tool to implement many of the above suggestions and promote long-term corporate

governance.

Conclusion

Short-Termism and Shareholder Value Governance are

crucial social problems for America which if not addressed will continue to

damage the industrial base and with that increase poverty in America and the

growing disparity between haves and have-nots. As set forth above, there are

many possible tools available to the Federal government to address these

issues. The extent to which their use is

necessary will depend on the response by Wall Street and corporate directors

and management to the growing outcry about this problem and the prospect of

increased regulation.

Andrew D. Hendry

January 25, 2016

(Updated November 11, 2016)

andrewdelaneyhendry@gmail.com