PORTLAND OREGON'S GOVERNMENT

Portland Oregon is a beautiful city; no question about it and it's probably a great place to live. Just look at it:

But, unfortunately, it looks to me like it doesn't have the sharpest city government you could hope for. You know: "CITY GOVERNMENT," the folks that are suppose to collect the garbage, water the grass in the parks, put out fires, keep the streets clean, etc., all by the way being critical things to our daily happiness. Their job is not, however, to try to regulate Corporate America, Wall Street, global commerce and the like. They neither have the skills, experience or power to do that.

Unfortunately, as you may have read in the NY Times (see link below), the Portland City Government recently passed a tax on corporations that pay their CEOs more than 100 times the average workers pay.

Now, don't get me wrong, I'm not defending out of line CEO pay. That's a big topic that I'm not trying to address here. I will say that CEOs have huge responsibilities and the welfare of many depend on them. The successful ones deserve to be very well paid. Some may be overpaid, not all though. But today a lot of people are overpaid or at least stratospherically paid, like sports heroes, movies stars, singers, hedge fund managers and on and on, the 0.1%. This law by targeting business discriminates and we all know why. You can get a lot of political mileage by going after business, not so by going after the $100 million contract for a star athlete that jacks up ticket prices for families, rich and poor alike.

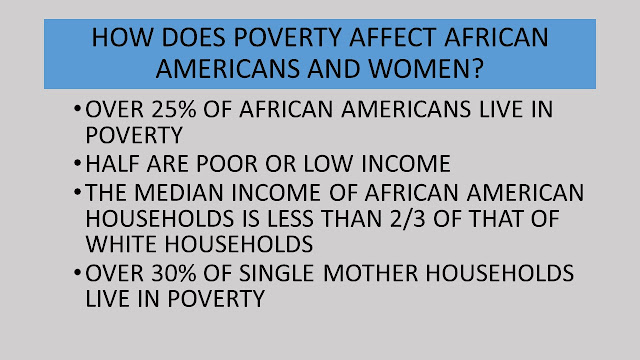

The real problem with the law isn't that it discriminates against business (I'm sure everyone would get teary eyed over that). The problem is that the law will be totally ineffective in addressing income inequality, its intended target, and along the way may well actually hurt the people it is trying to help:

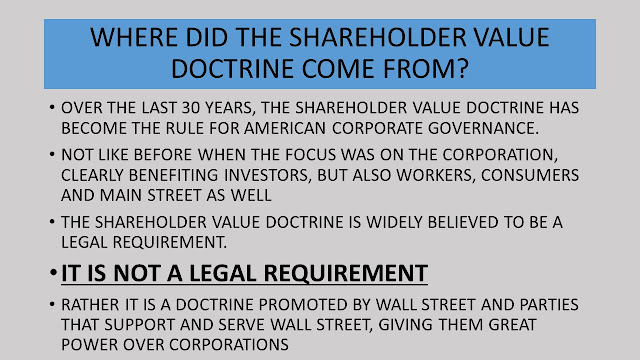

- First, the real problem today is not how much CEO's and other corporate executives are paid. It is what they are paid for. Paying executives for enriching the "investors" quickly as opposed to building and strengthening their businesses is the problem. Executives should not be handsomely rewarded for firing people (restructuring), moving jobs out of the United States (efficiency) and other actions with the purpose of making more cash available to distribute to Wall Street. They should be rewarded for building their businesses, creating new products and jobs, fostering long-term growth and the like, not for enriching Wall Street with short-term profits at the expense of Main Street.

- Who do you think will ultimately pay for the tax:

A. The CEOs

B. Wall Street

C. Consumers

- Well, if you answered C, you're right. The increased cost will eventually be passed-on to consumers through higher prices (or some other way), including to the citizens of Portland. So, the city leaders might just as well have taxed the people directly and been done with it.

- Lastly, the "Donald" may be able to build a wall, but I doubt that Portland can. Beaverton, please get ready for an influx of business.

The sad thing about all of this is that while politicians like these grandstand with sound-good, stupid ideas (often to advance their own careers), we are all led astray and encouraged to take our collective eye off the real ball, SHORT-TERMISM, which if addressed would go a long way to creating opportunity and raising incomes. Short-Termism is a major contributor to the loss of opportunity in our society, stagnant wages and the slow demise of the middle-class.

The honorable mentions for this award go to former Senator Chris Dodd (who came out of the Washington revolving door to become one of Hollywood's chief lobbyists) and former Congressman Barney Frank (I believe he became a director of one of the banks he worked so hard to regulate), who together authored the law that is the foundation for this nonsense, and to the SEC that has steadfastly refused to implement real change while working on this sort of thing.

Look for my next blog: What was the Greatest Innovation in the last 200 years?